Is this just a minor correction or back to 08 times? Just curious on what people think.

DaPompous

2,231 posts

·

Joined 2005

General concensus says, Get out now! Its going to take a monster hit in the near future! You heard it here first! Good luck..

149 posts

·

Joined 2013

The current administration has been printing money to prop up the market. It can work for a while but is not a good long term strategy. So now they are easing off of the printing and people are getting nervous. My financial guy has been saying that we could see a 10% correction at any time....and that was almost a year ago. So I was surprised when we went over 15000 and even more surprised when it went over 16000. I don't think will reach 08 proportions (which were catastrophic) but I think we could it could go low enough where people start to really worry. Or it may level off tomorrow!!

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

Who do you mean by the current administration. The federal reserve isn't democrat nor republican it is a private bank. The easy money policies were set up by the federal reserve which allows for the government to issue debt through bonds. That is the whole situation right now. The fed is going to taper it's U.S. Treasuries purchases. O8 could happen very easily, all that needs to happen is one major catalyst like more countries currencies failing.The current administration has been printing money to prop up the market. It can work for a while but is not a good long term strategy. So now they are easing off of the printing and people are getting nervous. My financial guy has been saying that we could see a 10% correction at any time....and that was almost a year ago. So I was surprised when we went over 15000 and even more surprised when it went over 16000. I don't think will reach 08 proportions (which were catastrophic) but I think we could it could go low enough where people start to really worry. Or it may level off tomorrow!!

And if the fed continues to taper, then we should expect the equities markets to collapse with all the easy money that came with QE. The question is will the fed continue to taper if the markets start crashing or go back to QE. That is the question at hand.

1,190 posts

·

Joined 2006

The DOW rose, what, 27% last year with 50+ new record highs? Last year was a pure upward market and everybody made easy money. It was due for a correction and that is what you are seeing. It got a little over heated especially toward the end of the year.

There are some good buys out there for the long run right now.

There are some good buys out there for the long run right now.

1,476 posts

·

Joined 2003

Investors are seeing more states legalizing Marijuana and are afraid people will become lazier and not work or spend money to stimulate the economy. Just kidding of course, I wanted to stir up the potheads on this site.

5,825 posts

·

Joined 2004

It is Obama's bubble. The gold bubble is popping so it is time for the market bubble to let out about 4000 worth of air.

189 posts

·

Joined 2012

It doesn't really matter what the DOW does, just as long as you are on the right side of the trade. That's the hard part...predicting the market.

If you KNOW the market is going to tank, then the last thing you would want to do is get out of the market. You can easily put your money in an inverse ETF like SDOW and make a killing of a return in a short amount of time--if you are right.

With today's financial instruments that are available to everyone, you can make money if the stock market goes up, down, or sideways in just about any type of account that you have... the hard part is being correct in your predictions more times than not.

If you KNOW the market is going to tank, then the last thing you would want to do is get out of the market. You can easily put your money in an inverse ETF like SDOW and make a killing of a return in a short amount of time--if you are right.

With today's financial instruments that are available to everyone, you can make money if the stock market goes up, down, or sideways in just about any type of account that you have... the hard part is being correct in your predictions more times than not.

149 posts

·

Joined 2013

Agreed. That wasn't fair. I let an editorial sneak in there....This isn't party based. And I think you're right on the question. Nobody wants the market to tank including the Reserve. I suspect they will back off on the tapering as necessary. The emotional aspects of the market are hard to predict and are what concern me. Regarding the other comments, I've found that I can only successfully time the market about 50% of the time...which are the same odds as a coin flip. Not judging the abilities of others...that's just my experience.

189 posts

·

Joined 2012

I see QE as having much more to do with stabilizing the real estate market and getting the USA out from under the large inventory of foreclosures and short sales (real estate based loan defaults).

The stock market has everything to do with how many people are buying stock versus selling stock at any given moment...and that's about it.

After QE, there will most likely be higher mortgage interest rates over the next few years. Will that change people's attitude of buying versus selling stocks? Who knows... where else are people going to put their money? ...especially, if the QE taper leads into a period of inflation that outpaces risk-free returns by a good margin. If loans become easy again, then inflation might start cranking up...how will people use their money to make more money?

The stock market has everything to do with how many people are buying stock versus selling stock at any given moment...and that's about it.

After QE, there will most likely be higher mortgage interest rates over the next few years. Will that change people's attitude of buying versus selling stocks? Who knows... where else are people going to put their money? ...especially, if the QE taper leads into a period of inflation that outpaces risk-free returns by a good margin. If loans become easy again, then inflation might start cranking up...how will people use their money to make more money?

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

Foreign investors would use a carry trade to invest in the stock market and a lot of countries were doing this. With a taper rates went up some and ended a lot of carry trades. But at the same time as rates go up people will become less interested in home mortgages. So pick your poison I guess. Now with the carry trade coming to an end on the U.S. currency a lot of emerging markets are in Jeopardy. These sub prime countries can have a devastating effect on the world economy.I see QE as having much more to do with stabilizing the real estate market and getting the USA out from under the large inventory of foreclosures and short sales (real estate based loan defaults).

The stock market has everything to do with how many people are buying stock versus selling stock at any given moment...and that's about it.

After QE, there will most likely be higher mortgage interest rates over the next few years. Will that change people's attitude of buying versus selling stocks? Who knows... where else are people going to put their money? ...especially, if the QE taper leads into a period of inflation that outpaces risk-free returns by a good margin. If loans become easy again, then inflation might start cranking up...how will people use their money to make more money?

Most of the QE money actually went back to the federal reserve. I read over 80 percent of QE money was put back into the federal reserve by the banks to get some interest money. Banks don't want to lend because corporations have destroyed the U.S. job market. There is extremely high unemployment and no new industries except oil and pot. But that can't keep up with corporations destroying jobs in America.

1,012 posts

·

Joined 2006

It's a correction for our false "healthy" growing economy. At 15,000 plus if a correction of more than 2000 points happens in a day then get excited. At this level it is people who waited to take advantage of tax savings in 2014 selling off the profits versus being taxed in 2013.

5,825 posts

·

Joined 2004

Dedumbass-you think corporations took down this economy? Try greedy Wall Street criminals and banks with a ton of help from a corrupt government. Try loans to illegals for homes with the stated income rule when they were really earning $8 an hour. Try a Justice Department that would rather audit Franklin than prosecute Wall Street scam artists. This government took down the economy and I am thinking one day the market and the entire world economy will do a reset. This economy will never recover as long as banks can borrow money for nothing and invest it in Wall Street roulette instead of loans to Main Street. Better buy some more ammo.

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

Are not banks mega corporations? So what that banks buy politicians and play both sides. If I was a banker I wouldn't make a bad loan these days. Every one seems to be a risk. Who knows who will be let go from a job these days. Everyone is a risk just about, except the rich. If there wasn't so many government jobs this economy would have been ruined long ago. The top 1 percent got richer since 08, everyone else got screwed. And it is all our fault. We allowed corporations to ship jobs else where with no consequence. We allowed corporations to take away benefits. We allowed corporations to make wages stagnant for the last 30 years, while the guys that run the corporations make multi million dollar salaries each year. It is obvious that these ceo's don't have a conscience because it doesn't take brains to lay off a bunch of people so you can show a profit next quarter. It doesn't take Einstein to figure out if you cut your employees benefits profits will go up. All it takes is a heartless bastard with no soul. And this is what it takes to be on top of the corporate world. There needs to be a re-distribution of wealth. It has happened before, but will it happen before the petro-dollar scam is over. That is the question.

5,825 posts

·

Joined 2004

OK, so I agree that corporations that could did outsource jobs and with union and government pressures I can't blame them. You are obviously a communist and think the government can take away everything people have earned in a lifetime just so you can have it for your people. Please explain just how this "taking" will occur and who will be the brave souls that volunteer to implement the taking?

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

Ok so you are into the Viking mentality. Your generation raped and pillaged this country with the policies created by the people you voted in. And now you will die and leave the destruction for the coming generations. Who put small business out of business. Could it be the corporation. Small business use to be biggest employer in this country now it is the socialist government. You may knock unions but union membership is really low these days. And with that you got some of the worse working conditions with no benefits these days. That is just a fact.

5,825 posts

·

Joined 2004

Actually my generation worked harder than yours and we haven't started much of the raping yet. As we all go on Social Security which was invented by your people, then we will do a bit of pillaging. I think social security should be means tested and same for medicare. The citizens of this country put small business under by flocking to Wal Mart. An easy fix is to stop buying imported products. Corrupt politicians and corporations can't force us to buy imports so what are we waiting for?

580 posts

·

Joined 2010

I'd love to buy American...but there is no more "American"....everything is sourced from abroad...Actually my generation worked harder than yours and we haven't started much of the raping yet. As we all go on Social Security which was invented by your people, then we will do a bit of pillaging. I think social security should be means tested and same for medicare. The citizens of this country put small business under by flocking to Wal Mart. An easy fix is to stop buying imported products. Corrupt politicians and corporations can't force us to buy imports so what are we waiting for?

Back in the 1970's, everything, from clothes, to cars, to stereo's, to pots and pans were made in America...but America decided not to keep up...we rested on our laurels, thought we, as an industrious nation were untouchable...

I remember it too well...my dad and all of us, sitting around, looking at the 'Jap Crap' and laughing about it starting to show up at stores...thought we were never gonna get eclipsed...

Now, if I want to buy and American sweater, Polo shirt, toaster, vacuum, whatever (not brand, but actually mfg in the USA), where do I go???

Even Craftsman tools are 'Made in China'....I nearly puked a few years back when I saw that on the craftsman tools at sears...

5,825 posts

·

Joined 2004

It all started with WalMart back in the early 80's. Sam Walton flew his private jet to China more that the US ambassador. He then got up to a huge share of my customer's business and threatened to discontinue all of their brands if they didn't set up manufacturing in China. I hope he is rotting in hell right now.

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

Walmart employs 2.4 million people worldwide. 1 million of those workers are foreign employees. Not only that, their wages blow for their American employees. Shit jobs equal a shit economy for the masses, but the one percenters sure love it.

4,192 posts

·

Joined 2006

Large corporations are not to blame for jobs going overseas, the American consumer and our government is.

The American consumer wants it CHEAP. Most bitch about jobs leaving the states but then turn around and buy the cheaper product made overseas. Hell there is a thread right now talking about Tundra's. I don't give a shit where that truck is built, the profits go back to Japan.

Our own government has taxed the hell out of corporations. This is a big reason they move production overseas. There is an advertisement running right now promoting New York as a place to move or start your business because they wont tax the company for 10 years. (NY finally gets it!)

In addition, due to EPA regs a lot of companies go to China or Mexico for manufacturing. Its to expensive to meet all the rules and regulations and still make a product cheap enough the American consumer will buy it.

One more thing, I love you guys who complain that corporations don't pay enough taxes. My company is a corporation and my tax is a flat 25%. However, any DBA or corporation that shows a taxable profit needs to fire their controller. Corporate profits are taxed and then taxed and then taxed. heres how it works.....

A corporation shows a taxable profit and pays the tax.

The money left is used a number of ways....

Owner or CEO etc bonus. The company pays payroll tax and the owner/CEO pays income tax.

Employee payroll....The company pays payroll taxes and the employee pays income taxes.

Employee bonus, see above.

Spent to acquire property or add a building. Company pays property tax, sales tax and or occupancy tax.

Company adds inventory. Any inventory added during the year is taxed at the end of the year.

Company pays a dividend to its shareholders. The shareholders pay a tax on the income.

ETC> ETC> ETC>

For my company, we spend what we make. It would be pretty damn stupid to pay a corporate income tax and then pay another tax on how I use the money.

Oh ya, I own a small business with 49 employees. Small business's still employ the most.

The American consumer wants it CHEAP. Most bitch about jobs leaving the states but then turn around and buy the cheaper product made overseas. Hell there is a thread right now talking about Tundra's. I don't give a shit where that truck is built, the profits go back to Japan.

Our own government has taxed the hell out of corporations. This is a big reason they move production overseas. There is an advertisement running right now promoting New York as a place to move or start your business because they wont tax the company for 10 years. (NY finally gets it!)

In addition, due to EPA regs a lot of companies go to China or Mexico for manufacturing. Its to expensive to meet all the rules and regulations and still make a product cheap enough the American consumer will buy it.

One more thing, I love you guys who complain that corporations don't pay enough taxes. My company is a corporation and my tax is a flat 25%. However, any DBA or corporation that shows a taxable profit needs to fire their controller. Corporate profits are taxed and then taxed and then taxed. heres how it works.....

A corporation shows a taxable profit and pays the tax.

The money left is used a number of ways....

Owner or CEO etc bonus. The company pays payroll tax and the owner/CEO pays income tax.

Employee payroll....The company pays payroll taxes and the employee pays income taxes.

Employee bonus, see above.

Spent to acquire property or add a building. Company pays property tax, sales tax and or occupancy tax.

Company adds inventory. Any inventory added during the year is taxed at the end of the year.

Company pays a dividend to its shareholders. The shareholders pay a tax on the income.

ETC> ETC> ETC>

For my company, we spend what we make. It would be pretty damn stupid to pay a corporate income tax and then pay another tax on how I use the money.

Oh ya, I own a small business with 49 employees. Small business's still employ the most.

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

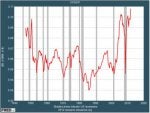

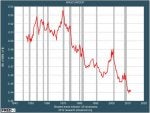

First chart shows that corporate profit margins are at an all time high. So much for the to much regulation and to much taxes ideas.Large corporations are not to blame for jobs going overseas, the American consumer and our government is.

The American consumer wants it CHEAP. Most bitch about jobs leaving the states but then turn around and buy the cheaper product made overseas. Hell there is a thread right now talking about Tundra's. I don't give a shit where that truck is built, the profits go back to Japan.

Our own government has taxed the hell out of corporations. This is a big reason they move production overseas. There is an advertisement running right now promoting New York as a place to move or start your business because they wont tax the company for 10 years. (NY finally gets it!)

In addition, due to EPA regs a lot of companies go to China or Mexico for manufacturing. Its to expensive to meet all the rules and regulations and still make a product cheap enough the American consumer will buy it.

One more thing, I love you guys who complain that corporations don't pay enough taxes. My company is a corporation and my tax is a flat 25%. However, any DBA or corporation that shows a taxable profit needs to fire their controller. Corporate profits are taxed and then taxed and then taxed. heres how it works.....

A corporation shows a taxable profit and pays the tax.

The money left is used a number of ways....

Owner or CEO etc bonus. The company pays payroll tax and the owner/CEO pays income tax.

Employee payroll....The company pays payroll taxes and the employee pays income taxes.

Employee bonus, see above.

Spent to acquire property or add a building. Company pays property tax, sales tax and or occupancy tax.

Company adds inventory. Any inventory added during the year is taxed at the end of the year.

Company pays a dividend to its shareholders. The shareholders pay a tax on the income.

ETC> ETC> ETC>

For my company, we spend what we make. It would be pretty damn stupid to pay a corporate income tax and then pay another tax on how I use the money.

Oh ya, I own a small business with 49 employees. Small business's still employ the most.

Second chart shows that fewer Americans are working. That is because Americans are not as profitable as foreign workers.

Third chart shows that wages as percent of gdp are at a historical low. Just another reason corporations are so profitable is because they pay such low wages now.

What this shows is there are a few million aristocrats in American and there is now 300 million peasants. Nice system that has been created.

A small business is defined as a business with less than 500 employees according to the government. Once again I think a business with over 50 employees is at least medium size. Point being the definition of a small business is all relative to one's opinion.

Attachments

-

26.1 KB Views: 123

-

31.4 KB Views: 118

-

32.1 KB Views: 119

4,187 posts

·

Joined 2012

Bunch of goddamn tards in this thread. Im expecting the sons of the greatest generation to start crowing about how they singlehandedly saved this country and made it what it is today.

DaPompous

Discussion starter

1,284 posts

·

Joined 2013

Smart people understand that America became what it is because we were the last major country with factories after world war 2. America had no competition really in manufacturing during that time. Europe and Japan were in ruins. What is funny is things were bad during the early 70's with the collapse of the gold system. America used oil in the 70's to fund their debt and we have been under that system since. That is why it is so important that we become the number 1 exporter of oil. That way we can push our debt onto the world economy. If China had oil reserves we would be in some major trouble. The last time I checked the U.S. is still number 1 in manufacturing. The U.S. also has an unfair advantage over the world. We get to print money out of thin air and buy oil with it because we are the world's reserve currency. That must piss a lot of foreign countries off. We run up a huge debt and outsource it to foreign countries along with inflation.

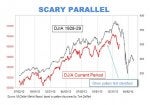

Right now I am beginning to believe we might see a major down turn again in the economy. Two charts are floating around the investment forums and it has a lot of people worried. Here are the two charts.

Right now I am beginning to believe we might see a major down turn again in the economy. Two charts are floating around the investment forums and it has a lot of people worried. Here are the two charts.

Attachments

-

41.8 KB Views: 141

-

23.8 KB Views: 135

189 posts

·

Joined 2012

Well, the Dow made it back up...Feb 3rd was the start of this thread.

It didn't follow the scary 1929 parallel graph.

You just never know for sure what the market is going to do...

![Image]()

It didn't follow the scary 1929 parallel graph.

You just never know for sure what the market is going to do...

Attachments

-

34.7 KB Views: 286

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

- posts

- 942K

- members

- 37K

- Since

- 2003

A forum community dedicated to anglers and fishing enthusiasts in Arizona. Come join the discussion about safety, gear, tackle, tips, tricks, reviews, reports, accessories, classifieds, and more!

Explore Our Forums